Acquisition and Succession Planning: How Business Loans Can Help You Keep Your Business’s Legacy

As any small business owner knows, the goal of building a business is often much more than just to make a profit. They hope to create a business and legacy that lasts. That’s why succession planning is so important to most small business owners. Appropriate planning can allow a company to continue, even after the founders have moved on.

However, this is often a challenge. Small business owners may value their legacy, but they’re often too busy to even think about succession planning. The frantic pace of work can make running a small business challenging, and planning for the future might be low on the list of priorities.

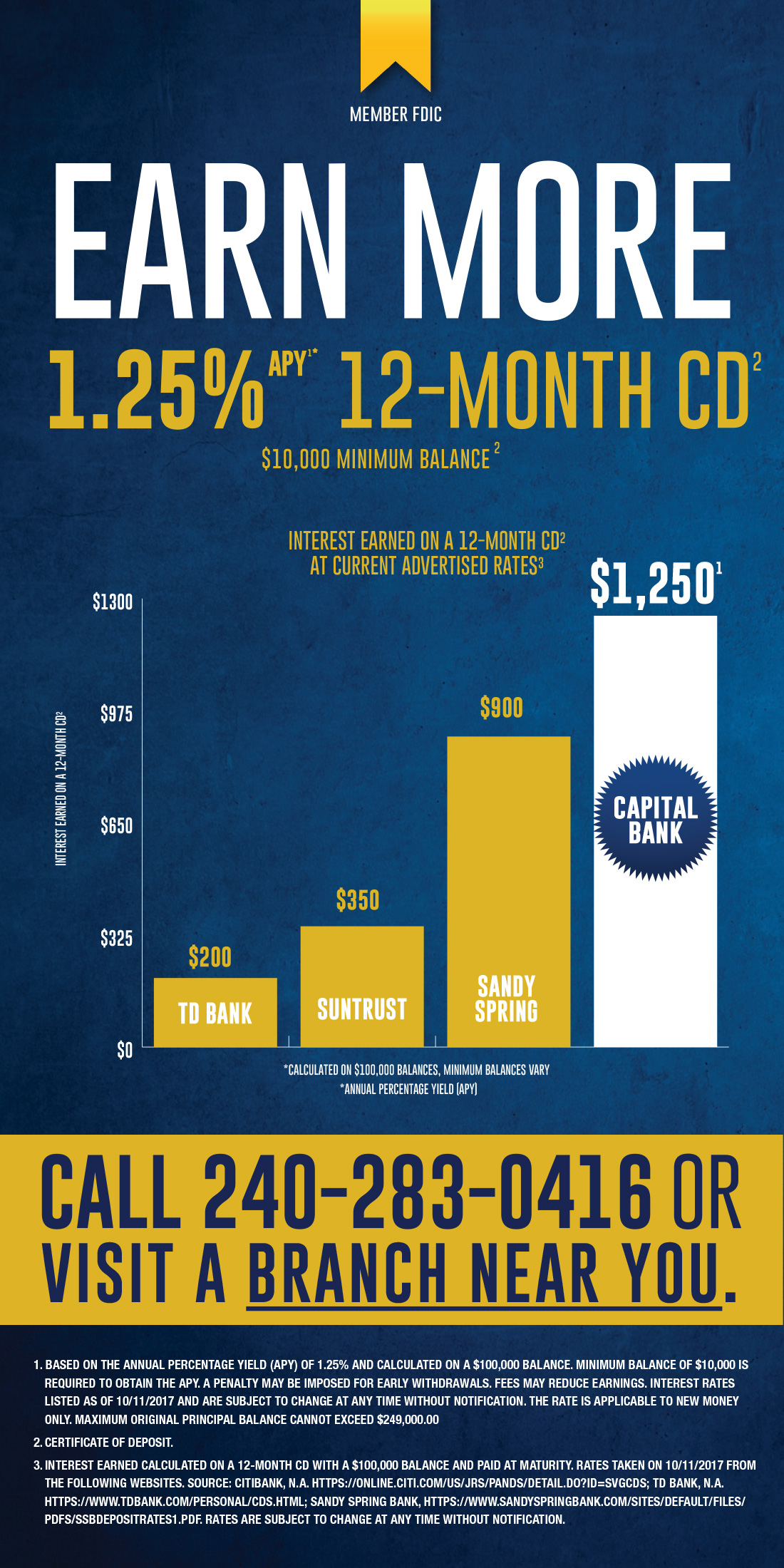

Thankfully, when you’re ready to start thinking about it there is no shortage of options to explore. Many banks — including Capital Bank — can offer small business loans to finance an acquisition. When used properly, a small business acquisition loan can be an ideal option and a critical component of your business succession planning.

Challenge us to find solutions

Get in TouchSBA Loans May Be the Right Option for Small Business Acquisition and Business Succession Planning

Family members or acquaintances are frequently a part of succession planning. When that’s not an option, a business owner may turn to a loyal employee to carry on the legacy. However, that can be a challenge: The employee may not have the capital to make a purchase, and they may not be able to get a loan from a traditional source.

This is where a Small Business Administration (SBA) loan can come in. A potential buyer can use an SBA loan to make the purchase. Indeed, SBA loans are common sources of financing and income for small business mergers and acquisitions. There are a variety of loans that are available for this exact purpose. These loans include Standard 7(a), a 7(a) small loan, SBA Express, and others. In addition, special products, like Veterans Advantage, also apply to specific segments of the population.

Fortunately, working with a bank with vast expertise in SBA lending makes the process of obtaining an SBA loan more efficient. For example, at Capital Bank, we’ve won awards for our work with the SBA, which includes transforming our application process into a digital one. We also helped small businesses acquire more than $375 million in Paycheck Protection Program (PPP) loans during the pandemic, providing critical assistance in keeping these businesses afloat. In addition, we have the experience and expertise to help you get a small business acquisition loan for succession planning purposes.

Things to Consider in the Succession Planning Process and Small Business Merger and Acquisition

Succession planning is not something that should come at the last minute. Every business owner should have a general idea of how they want their business to run when they’re no longer there or in the event of an emergency that may make the operation of the business impossible.

You’ll need to make some specific considerations as a small business owner or purchaser of a small business. Keep in mind the following characteristics when it comes to this type of planning:

Current Owner and Small Business Acquisition Loans

- Any effort to sell a company should start with a solid valuation. You’ll want to determine how much it’s worth before planning for succession and deciding how much you’ll ask for. The sooner you know this figure, the sooner your prospective buyer can begin putting together the financing necessary for the purchase.

- Make sure to consider the potential tax liabilities of any transfer. Work with an accountant to minimize these liabilities and determine what you need to do to keep your tax burden at the lowest possible level.

- If you’re working with a long-time employee or another individual looking for SBA financing, be prepared to assist. The individual may have no experience with financing like this, and you may have to help them through the process.

Future Owner and Financing A Small Business Acquisition

Purchasing a small business from a friend, family member, or even your boss can be an exhilarating experience. However, it will help if you remember a few things regarding the purchase:

- Demand transparency. You may have worked for the company for many years, but you still need access to all the books, accounts, and relevant data to make an informed decision.

- Plan for a transition. Even after a sale is closed, the odds are good that you’ll need assistance with the transition from the old owner to you. Consider hiring the outgoing owner to work as a consultant or on a per diem basis for a few months. This staffing arrangement can ease the pain of the transition.

- Make sure you’re working with an expert. You’ll need a bank that can give you your best financing options and has all options available. You’ll likely want to find a bank with expertise and experience, particularly with SBA loans, a common source of business acquisition loans.

Challenge us to find solutions

Get in TouchHow to Get a Small Business Acquisition Loan

As you can see, SBA loans offer extensive opportunities for your business, particularly from a succession planning perspective. These loans are flexible, affordable, and designed for many purposes, including planning. By incorporating SBA financing into your planning efforts, you put yourself in a stronger position to continue your business, even after you retire. At the same time, you can help an employee access the capital that will allow them to continue with your legacy.

Are you looking for more information on succession planning, small business acquisition loans, or the best way to conduct a small business merger and acquisition? At Capital Bank, we’re here to help. We offer an array of succession planning resources and Small Business loans that can ensure your business legacy lives on and that an employee can acquire the financing necessary to continue the proud business tradition you’ve built. Visit our webpage to learn more about how we can help finance a small business acquisition.