-

How a Recent Legal Settlement Could Impact the Way Homes Are Bought and Sold

Post Date: 4/11/2024 A recent legal settlement by the National Association of Realtors® (NAR) could have a major impact on how homes are bought and sold in the U.S. In the case of Burnett v. NAR, NAR agreed to pay $418 million in damages to a group of home sellers who sued over NAR’s long-standing […]

Read more -

The Risks of Using Attorney-opinion Letters in Lieu of Title Insurance

On April 6, 2022, Fannie Mae introduced attorney-opinion letters (AOLs) as an alternative to title insurance for certain home mortgages to attest that there are no problems with a property’s title. Then last December, Fannie announced that it would expand the types of mortgages it will purchase that rely on AOLs to include condos and properties subject to a homeowner’s association (HOA).

Read more -

SBA Loans: An Ideal Solution for Partner Buyouts

Buyouts in partnerships are not uncommon. Sometimes one business partner decides they have different goals from the other or wants to retire or shift into a different line of business.

Read more -

Business Tax Strategies for the New Year*

Tax planning is a crucial component of business success. Because as the old saying goes, it’s not how much money you make that counts, but how much money you keep. With tax season approaching, now is a good time to think about business tax strategies. Here are three tax strategies to consider with your CPA […]

Read more -

Pioneers of Progress: Recognizing African American Financial Entrepreneurs

In recognition of Black History Month, Capital Bank is spotlighting prominent African Americans who have been pioneers in the financial services industry. These African American entrepreneurs demonstrated a strong spirit of innovation, resilience and impact that changed the financial and business worlds.

Read more -

Understanding the Critical Role of a Business Plan

In the dynamic and often unpredictable world of business, having a roadmap is not just useful—it’s essential. This is where a business plan comes into play. It serves as a strategic guide, a blueprint for decision-making, and a vital tool for growing your business.

Read more -

How to Prevent Business Check Fraud

With the advent of digital payments, far fewer individuals today use paper checks to pay for goods and services than in the past. In fact, many retailers no longer accept checks for payment. So, it’s ironic that check fraud is currently on the rise.

Read more -

Navigating Your Business Journey: The Four Stages and What You Should Be Thinking About

Picture this, you’re on a cross-country road trip. There are going to be pit stops, roadside attractions, maybe a few speed bumps, and definitely some amazing sights along the way. Just like a road trip, the journey of a business is not a straightforward drive.

Read more -

Beneficial Ownership: What You Need to Know

Starting in 2024, there are some changes to the information needed to report beneficial ownership to the Financial Crimes Enforcement Network (FinCen). To help you understand what beneficial ownership is, the changes that are being made, and what you need to do to keep your business protected, we put together the following FAQs.

Read more -

Naughty or Nice: How to Protect Yourself from Holiday Fraud

Tis’ the season to take advantage of special discounts and savings from your merchant partners. However, it is important to protect yourself and your business when shopping this holiday season. Check out these tips for banking and shopping smart this season and avoid that “lump of coal” feeling. 1. Regularly Monitor + Set Alerts on […]

Read more -

Navigating the Shopping Rush – Tips for Small Business Owners

As the holiday season approaches, small business owners everywhere are gearing up for what is often the busiest and most profitable time of the year. The shopping rush, which includes Black Friday, Cyber Monday, and the entire holiday season, presents a unique set of challenges and opportunities for small businesses. Here are some helpful tips […]

Read more -

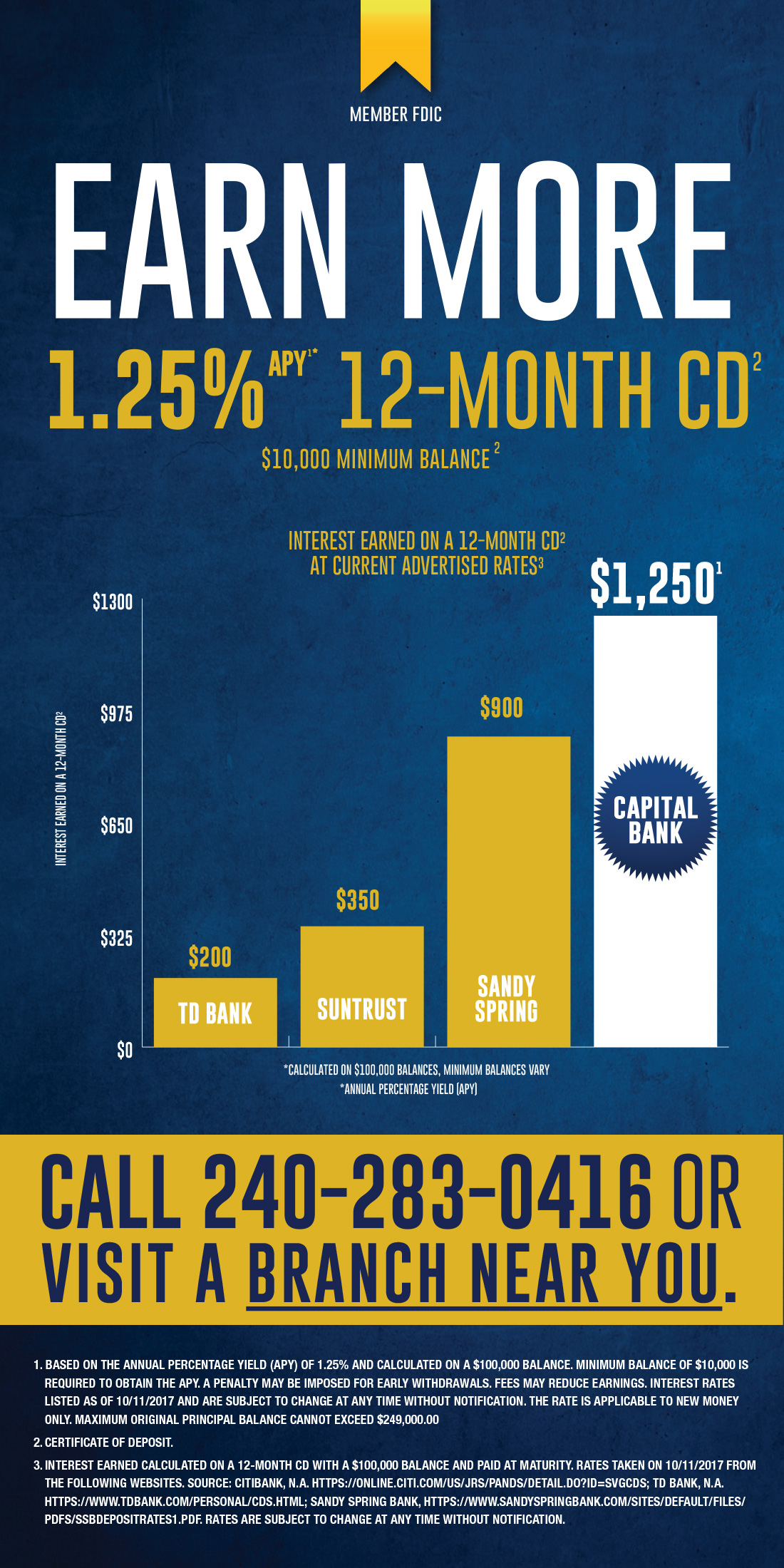

The Top 5 Reasons to Keep Savings in a High-Interest CD Account in Today’s Economy

In today’s ever-changing economic landscape, both consumers and businesses are on the lookout for secure and profitable investment options. One such avenue gaining popularity is the high-interest Certificate of Deposit (CD) account. With the current instability in interest rates, a high-interest CD account offers a stable and lucrative option for savers. Let’s explore the top […]

Read more -

Effective Cash Management to Grow Your Business

In today’s highly competitive business landscape, financial acumen is more crucial than ever. If you are an entrepreneur, business owner, or simply someone interested in the world of finance, you may have encountered the term “cash management.” However, do you understand how it can drastically transform your business’s growth trajectory? Let’s explore the intricacies of […]

Read more -

The Power of Savings: Why Businesses Should Invest in Certificate of Deposit (CD) Specials

Business is not just about generating revenue and profits. It’s about long-term sustainability and strategic financial management. A part of this strategy is ensuring that the business not only spends money wisely but also saves effectively. This is where a Certificate of Deposit (CD) specials can play a pivotal role. But why should businesses invest […]

Read more -

Acquisition and Succession Planning: How Business Loans Can Help You Keep Your Business’s Legacy

As any small business owner knows, the goal of building a business is often much more than just to make a profit. They hope to create a business and legacy that lasts. That’s why succession planning is so important to most small business owners. Appropriate planning can allow a company to continue, even after the […]

Read more -

How to Utilize Loans to Mobilize Your Restoration Team

Weather and climate disasters have cost the United States over $2.195 trillion since 1980 due to 323 disasters, according to the National Centers for Environmental Information. In 2021 alone, there were 20 events throughout the nation, from a major wildfire to four tropical cyclones. As a restoration company, you have the tools and expertise necessary […]

Read more -

Helping Businesses Recover from COVID’s Impact

As I listen to our business clients talk about how the pandemic has affected their companies, it’s like a hurricane without the wind, a 9.0 earthquake without the shaking, or a wildfire without the flames. Even though businesses haven’t been visibly demolished, many have been eviscerated. The building may be standing but it was quickly […]

Read more -

How Company Culture Can Empower a Team to Move Mountains

“One thing I believe to the fullest is that if you think and achieve as a team, the individual accolades will take care of themselves. Talent wins games, but teamwork and intelligence win championships.” That quote from Michael Jordan has been on my mind lately as I reflect on lessons we’re all learning during the […]

Read more -

Why Face-to-Face is a Winning Strategy – Even in a Digital World

Unless you’re a service-based business that must get “up close and personal” with clients, it’s likely that your business depends almost entirely on digital tools for most of your communications and interactions. AT&T found that 66 percent of small businesses would fail without wireless technology, while 41% of business owners have plans to increase technology […]

Read more -

No Surprises: Approach a Business Loan Application with Confidence

Previously, we talked about cash flow and the importance of bridging gaps before they happen. But do you know how to prepare if your business needs to take on debt? Perhaps you want to expand your business, or you’re pursuing other opportunities. According to a recent report by the Federal Reserve, nearly 60% of small […]

Read more -

Bridge Gaps Before They Happen

President Dwight D. Eisenhower famously said, “Plans are useless, but planning is indispensable.” When you’re running a business or organization, it can be difficult to find the time to step back and look at your operations, goals and opportunities. In fact, it’s easy to fall into doing the same thing over and over without realizing […]

Read more -

One-on-One: The Value of Listening to Your Clients

With the advent of the digital age, one-on-one conversation is becoming a thing of the past. With it has gone the fine art of listening — one of the most valuable tools for any relationship, both business and personal, using emails as a substitute for really listening and gathering feedback. In fact, if you fail […]

Read more -

SBA Loans Explained: How Creative Lending Options Can Turn Business Vision into Reality

Just like individuals making significant purchases or investments such as homes, cars, and education, business owners need loans to start, run, and grow their businesses. But each business and business owner has a unique story and circumstances, and traditional loans are not always the best fit for those needs. That’s where the U.S. Small Business […]

Read more -

Rethinking Employee Retention Strategies

With unemployment rates at a historic low in many sectors, it’s no surprise companies are looking for ways to retain their existing employees and position themselves competitively when recruiting new hires. Capital Bank is no exception. Based on our experience, we’ve found that a key factor in attracting and retaining employees is benefits — defined […]

Read more

Thinking Ahead

Capital Bank, N.A. is a community-focused, federally chartered, bank focused on serving the diverse needs of business owners in the greater D.C. Metropolitan area. Our success is directly related to partnering with our clients and helping to customize business-banking solutions that bring their vision to life.

That’s what built ‘Thinking Ahead’- endeavoring to deliver actionable insights on trending business and economic issues.