Products & Solutions

-

Depository

Our seasoned bankers have industry knowledge on the pain points of business and work with you — at your place of business or ours.

-

Treasury

We’ll craft the right suite of Treasury Services to help facilitate day-to-day business management of your cash flow.

-

Business Lending

We’ll work with you to think strategically about your borrowing needs, and tell you upfront what we can do for you — so you can plan your next steps sooner.

Browse All Products & Services

Featured Product

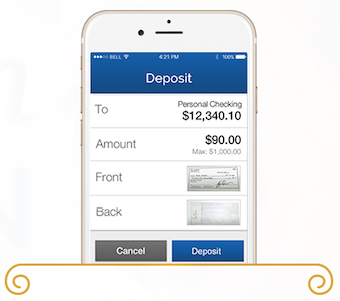

Online & Mobile Banking

Managing your cashflow anywhere your business takes you.

Learn More

Products & Solutions

-

Personal Checking

Our basic and interest-bearing accounts were designed to accommodate you, around the clock, wherever you are — with mobile banking on the go and 24/7 online banking with bill pay.

-

Personal Lending

Purchase a home, refinance the home you’re in and put its equity to work for you — we’ll customize a financing solution that fits your terms and budget, without unexpected headaches or hassles.

-

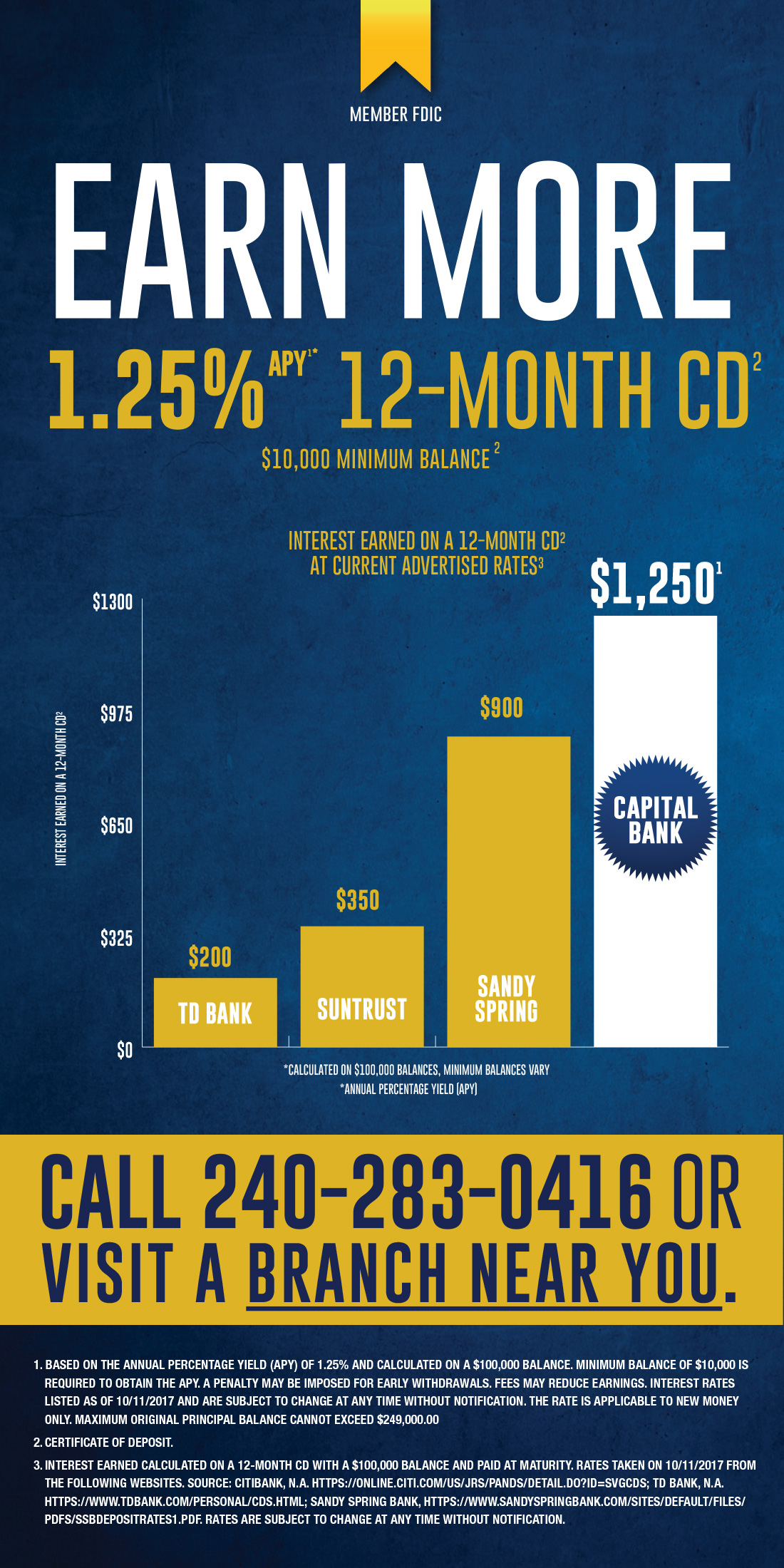

Personal Savings

From Money Market Accounts and competitive rate CDs to IRA’s, getting to see it all from your device makes it easy to deposit and move your money where you need it, when you need it.

Browse All Personal Products & Services

Featured Product

Online & Mobile Banking

Designed with Your Lifestyle in Mind.

Learn More

Executive Team

Capital Bank is proud to have some of the most talented executives at the helm, paving the way for a successful partnership with our customers. Working together with our Loan Officers and Business Bankers, our Executive Management team has brought Capital Bank into a new era of growth, with an exceptionally bright future ahead for the bank — and our customers.

Meet the Executive Team

Meet the Directors of our Boards