Beneficial Ownership: What You Need to Know

Starting in 2024, there are some changes to the information needed to report beneficial ownership to the Financial Crimes Enforcement Network (FinCen). To help you understand what beneficial ownership is, the changes that are being made, and what you need to do to keep your business protected, we put together the following FAQs.

What is Beneficial Ownership?

Beneficial ownership refers to the individuals who ultimately own or control a legal entity, such as a company, trust, foundation, or property. These individuals enjoy the benefits of ownership, even if the legal title is held by someone else.

What changes are happening in Beneficial Ownership Reporting in 2024?

Starting January 1st, 2024, the Federal government is requiring that all companies or business owners report beneficial ownership information to the Financial Crimes Enforcement Network (FinCen) directly. Countries are adopting more robust measures to ensure accurate and up-to-date information.

When do I need to file a Beneficial Ownership report with FinCen?

The Financial Crimes Enforcement Network (FinCEN) is extending the deadline for certain reporting companies to file their initial beneficial ownership information reports.

Companies created/ registered before January 1, 2024- have until January 1, 2025, to file their initial BOI reports with FinCen, while reporting companies created or registered on or after January 1, 2025, will have 30 calendar days to file their initial BOI reports after receiving actual or public notice of their creation or registration becoming effective.

Companies created/ registered after January 1, 2024- will have 90 calendar days from the date of receiving actual or public notice of their creation or registration becoming effective to file their initial reports. This extension will give reporting companies created or registered in 2024 more time to become familiar with FinCen’s guidance and educational materials.

FinCen will not accept reports until January 1, 2024 — no reports should be submitted to FinCen before that date.

Why are changes to Beneficial Ownership Reporting occurring?

Reporting beneficial ownership aims to help enhance transparency, prevent financial crimes, and curb corruption. It allows authorities to identify the real people behind legal entities, making it harder for individuals to hide illicit activities.

What information is required for Beneficial Ownership Reporting?

Typically, required information includes the names, addresses, and identification details of beneficial owners. Additionally, details about ownership percentages and the nature of control or influence need to be disclosed.

Who can access information reported in the Beneficial Ownership Reporting process?

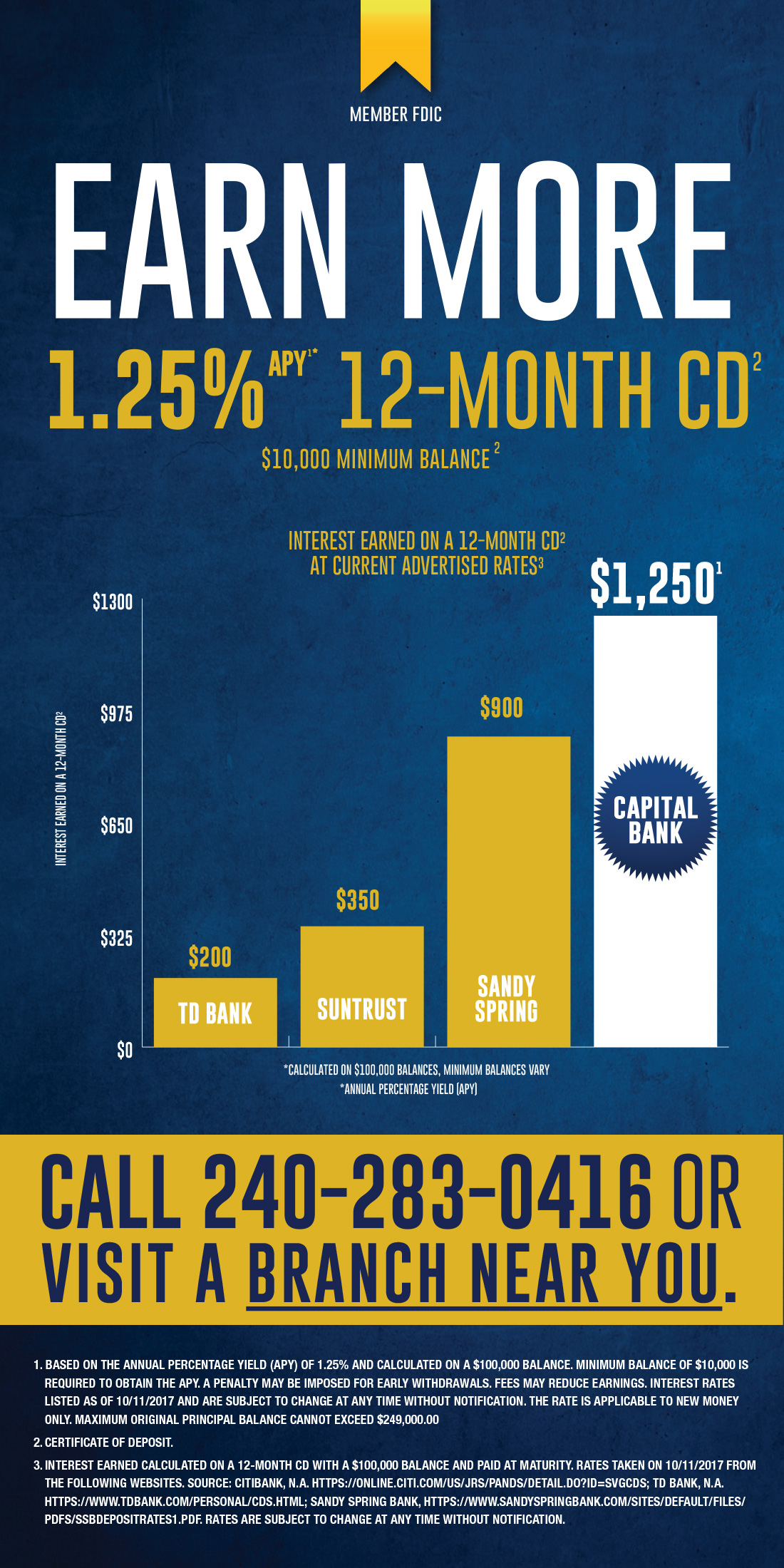

FinCEN will keep the information in a secure database that can only be accessed by certain officials who submit a request for reasons related to national security, intelligence, and law enforcement. Essentially, beneficial ownership information will only be accessed with intent, and kept locked away from the public. However, it’s important to note that financial institutions, such as Capital Bank NA, have access to beneficial ownership information, with the consent of the company, and will continue to collect beneficial ownership, when accounts are opened and periodically as needed, as they have since 2018.

Will small businesses be affected by these changes?

Small businesses are likely to be affected. However, many jurisdictions have tailored reporting requirements based on the size and nature of the business. It’s essential for small businesses to understand and comply with the specific regulations applicable to them.

How will these changes benefit businesses?

Enhanced reporting standards provide a level playing field for businesses, promoting fair competition. Moreover, by reducing the risk of illicit activities, businesses can foster a more secure and stable economic environment.

Are there penalties for non-compliance? If so, what are they?

Penalties for non-compliance can vary but may include fines, loss of business licenses, or in severe cases, imprisonment. It’s in the best interest of businesses to stay informed and ensure compliance with the updated reporting requirements.

How can businesses start preparing for upcoming changes to Beneficial Ownership?

Businesses should start by familiarizing themselves with the updated regulations in their jurisdiction. This may involve conducting internal reviews to ensure accurate and current beneficial ownership information. Seeking legal advice and using updated software for compliance tracking can also be helpful.

Where can businesses find additional resources on Beneficial Ownership and the upcoming reporting changes?

For more information, businesses can check with their local government agencies responsible for business regulation and compliance. Additionally, industry associations, legal professionals, and online resources often provide guidance on staying compliant with Beneficial Ownership Reporting changes. For more information on Beneficial Ownership Reporting and what to include in your report please visit the FinCen website.

Questions?

Contact us for more information.