Effective Cash Management to Grow Your Business

In today’s highly competitive business landscape, financial acumen is more crucial than ever. If you are an entrepreneur, business owner, or simply someone interested in the world of finance, you may have encountered the term “cash management.” However, do you understand how it can drastically transform your business’s growth trajectory? Let’s explore the intricacies of effective cash management and the role it plays in elevating your business to the next level.

What is cash management?

Simply put, cash management refers to the process of handling, monitoring, and optimizing the cash inflows and outflows within a company. While it sounds straightforward, mastering this art can be the difference between a flourishing enterprise and one that constantly struggles to stay afloat.

Why is effective cash management crucial?

- Maintains liquidity: One of the primary advantages is ensuring that businesses can meet their short-term liabilities, such as paying off suppliers, salaries, and rent.

- Capitalizes on opportunities: A well-managed cash reserve allows businesses to quickly jump on lucrative opportunities, such as inventory discounts or new investments.

- Minimizes financial costs: Effective cash management can reduce the need for loans and thereby decrease interest expenses.

What are the key components to cash management?

- Cash flow forecasting: This involves predicting cash inflows and outflows, helping businesses anticipate cash shortfalls or surpluses.

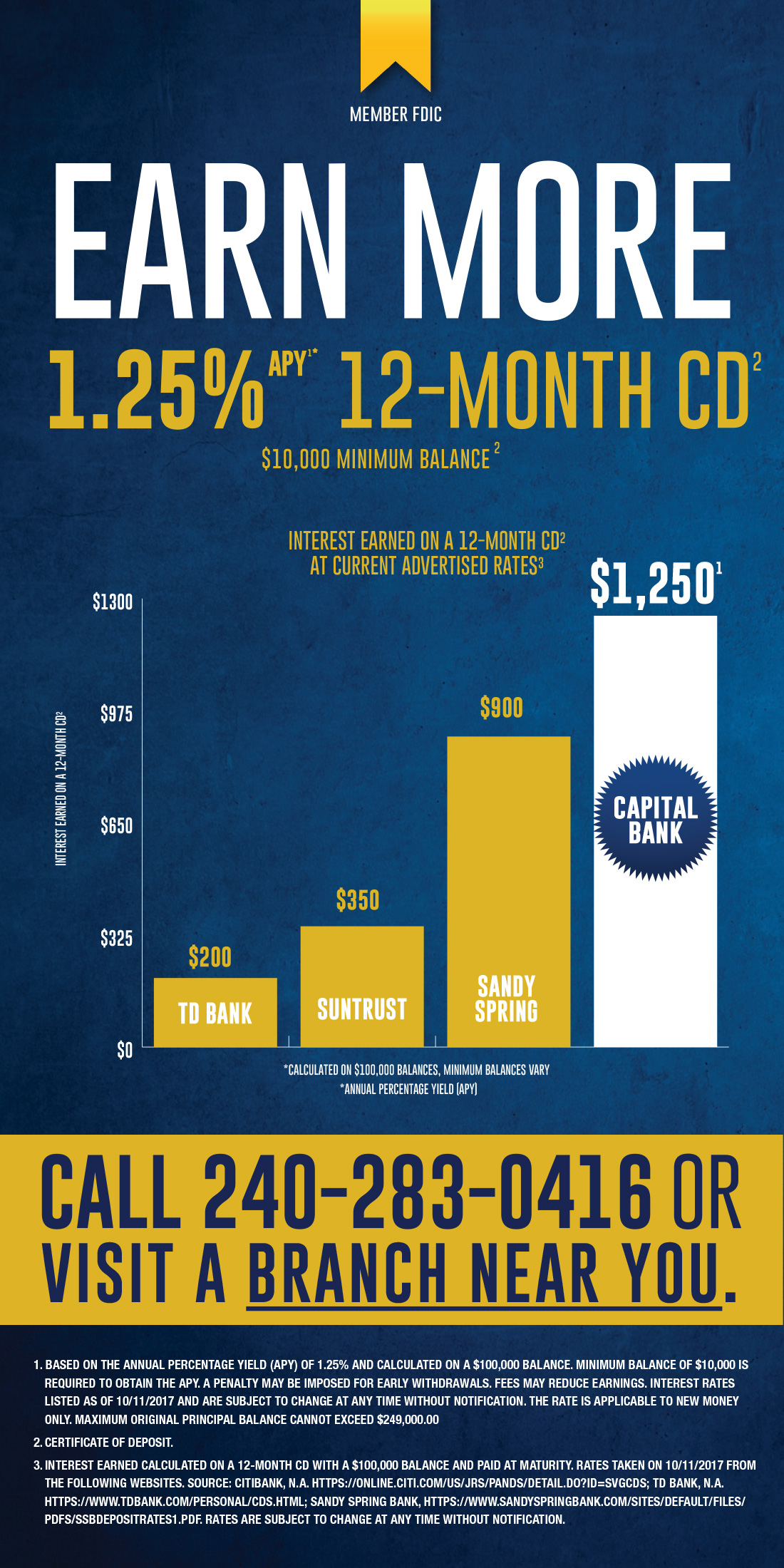

- Investment of idle funds: Temporary surplus cash can be invested in short-term securities, turning idle money into profit.

- Efficient Collection: Implementing faster methods of receiving payments, like electronic transfers or mobile payments, can accelerate cash inflows.

What pitfalls should you avoid?

- Overestimating inflows: A common mistake is being overly optimistic about incoming cash, leading to potential shortfalls.

- Not keeping a cash reserve: While investing is crucial, always ensure that you maintain a rainy-day fund.

- Mixing personal and business finances: This can obscure your business’s true financial position and lead to ineffective cash management decisions.

Cash is undoubtedly the lifeblood of any business, and managing it wisely is the key to long-term success. By working closely with your banker, accountant, or other financial advisors, they can help you navigate through the nuances of cash management, work with you to help you implement and ensure you’re implementing the right cash management strategies to help you build upon the success you’ve already achieved.