SBA Loans: An Ideal Solution for Partner Buyouts

Buyouts in partnerships are not uncommon. Sometimes one business partner decides they have different goals from the other or wants to retire or shift into a different line of business.

When this happens, the departing partner will usually need to buy out the other partner or partners. Partner buyouts can be complex transactions, especially if the buyout must be financed and the partner is unsure about where to source the capital to facilitate the transaction.

Advantages of SBA Loans for Partner Buyouts

One source of financing for partner buyouts is a Small Business Administration (SBA) loan. SBA lending is designed to help small businesses acquire necessary funds for a range of activities, including partner buyouts. SBA loans offer a number of advantages for owners who need to buy out a partner, including the following:

- Access to Adequate Capital — With loan amounts up to $5 million, the SBA 7(a) program is especially well-suited for these types of transactions, offering ample funding to buy out a partner’s ownership interest.

- Favorable Terms and Conditions — SBA loans offer long-term financing solutions with relatively low interest rates. This is especially beneficial for partner buyouts since the terms provide predictability and affordability, enabling the company to manage the buyout without unduly burdening the business’ cash flow.

- Versatility — SBA loans are not confined to a specific type of business or industry, though some businesses and industries are not eligible for SBA financing. This versatility makes them a flexible financing solution to partners of a broad range of different types of businesses.

- Lower Down Payments — Conventional loans often require large down payments, which can place an immense strain on a business’s resources. In contrast, SBA loans require smaller down payments, which provides significant relief to businesses undergoing partner buyouts.

- Preservation of Working Capital — With lower down payments and longer repayment terms, SBA loans enable businesses to retain working capital. This preserved capital can be reinvested in business growth and expansion, instead of being tied up in the buyout process.

New Rules Favor SBA Loans for Partner Buyouts

Also, new SBA rules on acquisitions make it easier to use an SBA 7(a) loan for a partner buyout. Previously, it was harder to use SBA loans for this purpose because the buyout process could potentially leave the business with negative equity. Now, the borrower does not need to contribute any equity toward the deal if the business has a debt-to-net-worth ratio of 9:1 and the remaining owners have held the same or increasing ownership interest in the business for at least the last 24 months. If the ratio is higher than this, the borrower must make a 10% down payment.

Secure a Business Valuation

The SBA requires a business valuation for all change of ownership transactions, and the valuation must be ordered by the bank. So before financing for a partner buyout can be secured, all partners must agree on a business valuation. If the partners can’t agree on this, an independent business valuator may need to be hired to come up with a valuation everyone can accept.

Also keep in mind that lenders will want to see that the business will remain viable after the partner leaves. So be sure your financial statements are in good shape and you have a succession plan before applying for an SBA loan to finance a partner buyout.

How Capital Bank Can Help

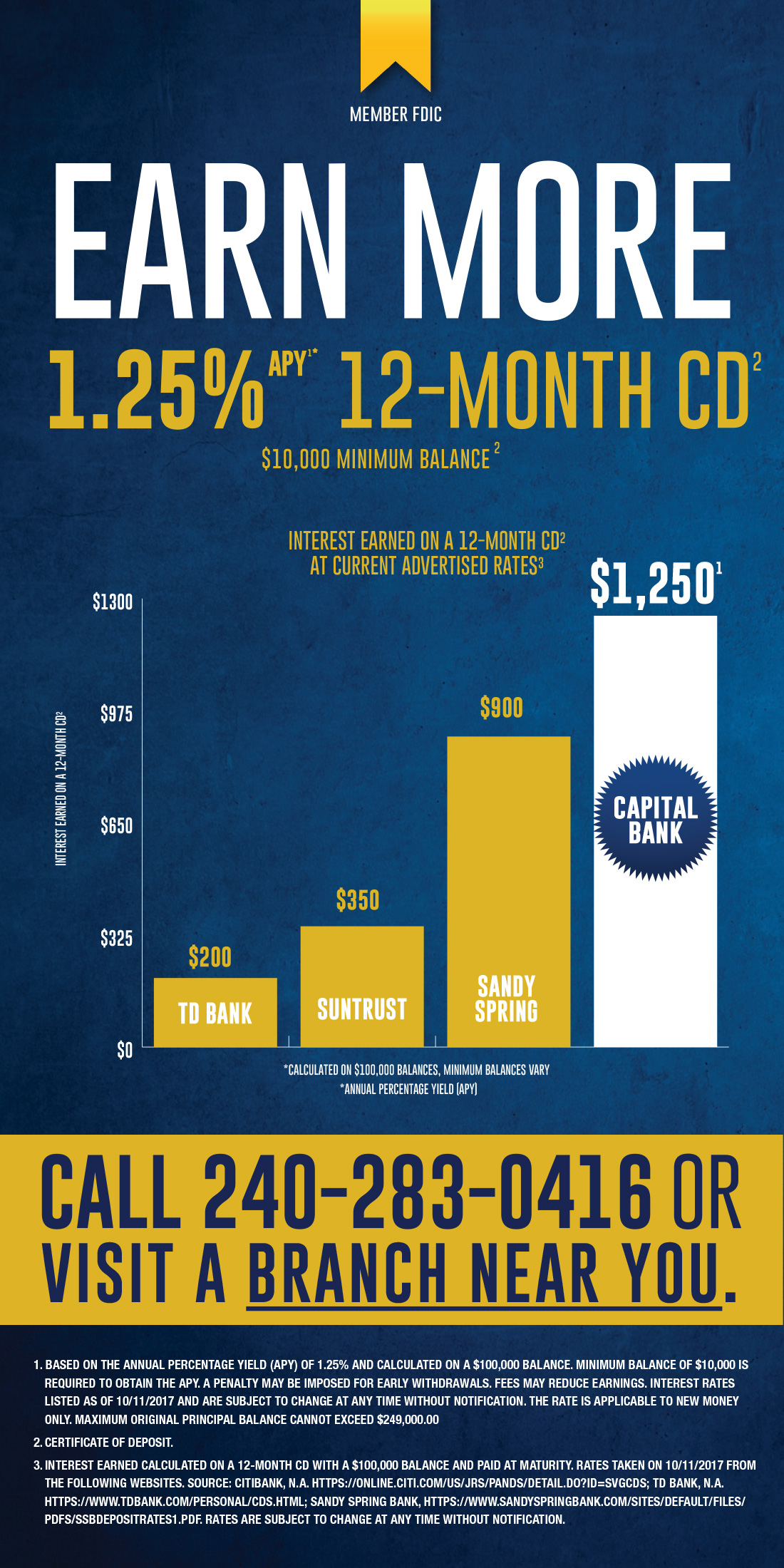

An SBA 7(a) loan is a robust and viable option for a partner buyout. The benefits of an SBA loan, from access to adequate capital to the preservation of working capital, underscore their utility and relevance in today’s business landscape.